We all know hard money loans can be expensive—10-18% interest on a short-term loan feels like a huge hit to your profits. But here’s the thing…

When used the right way, they can be a powerful tool to get deals done fast and maximize returns.

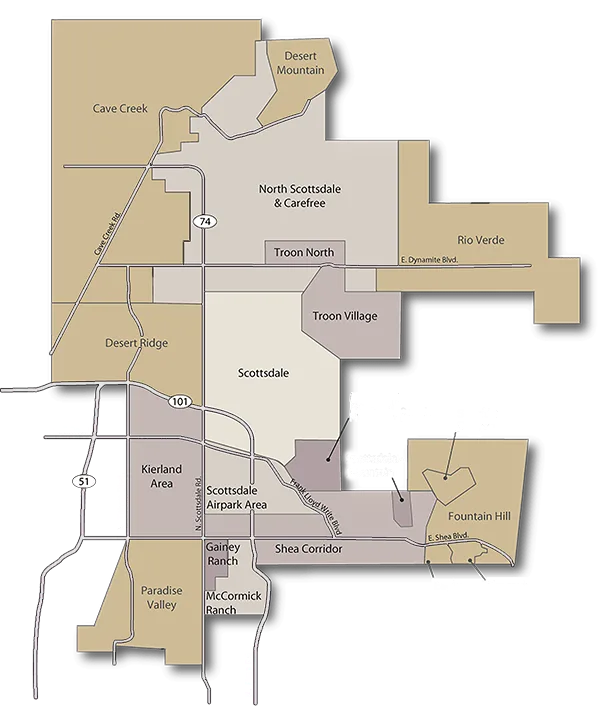

Hard money lenders can be a solid option when time is of the essence, and traditional financing isn’t cutting it. They give you the speed and flexibility to seize opportunities in a competitive market.

However, relying only on hard money loans means you’re constantly watching profits disappear into interest payments.

That’s why smart investors are making them part of a larger strategy…

What if you could pair the speed of hard money loans with a personal “financing machine” that allows you to recapture that interest, turning it into fuel for future investments?

Imagine a strategy where you get the best of both worlds: the quick closing power of hard money, and the ability to keep your own money growing—no strings attached.

You can use other people’s money when it makes sense, but at the same time, you’re building your own capital reserves that work for you, long after the deal closes.

Here’s the bottom line:

You could stick with hard money loans, and if it’s working for you, great. They can be a vital part of the plan.

Or…

Take the next 5 minutes to learn how to combine hard money lending with a financing strategy that lets you keep more profits while still using fast cash when needed.

You don’t have to ditch what’s working—just show up, and we’ll show you how to take it to the next level.

We’ve made it easy for you…Just take the first step and click to learn more.