As we hit middle age, financial worries often start to take center stage. With retirement looming, many realize their current strategies might not be enough to secure the future they envision. If this sounds familiar, you’re not alone. The good news? There’s a better way to prepare for the years ahead and build lasting wealth.

Retirement is meant to be enjoyed, but people often struggle to maintain their desired lifestyle. The fear of repeating the financial missteps of previous generations is real. But there’s hope for those looking to take control of their financial destiny and live life on their terms.

Here are seven key strategies that can help you build wealth and ensure a secure retirement:

1. Establish Your Own Private Banking System

The cornerstone of any solid financial plan is a strong foundation. A great start is consulting with an Authorized Infinite Banking Practitioner who can guide you through the benefits of specially designed dividend-paying whole life insurance policies. This powerful asset allows you to earn guaranteed, uninterrupted compound interest while still having access to your money.

2. Maximize Contributions to Your Policy

Don’t shy away from contributing as much as possible to your policy. The more you “deposit” into your private banking system, the greater your cash value becomes, providing you with a reliable source of funds for life’s opportunities. Remember, you can never go wrong by building up your cash reserves.

3. Leverage Policy Loans for Smart Investments

Your policy is just the beginning. Use the cash value as collateral to borrow against and invest in areas you know and trust—be it real estate, business ventures, or stocks. The key is to repay yourself with interest, just as you would with a traditional bank, allowing your wealth to grow.

4. Diversify Your Investments

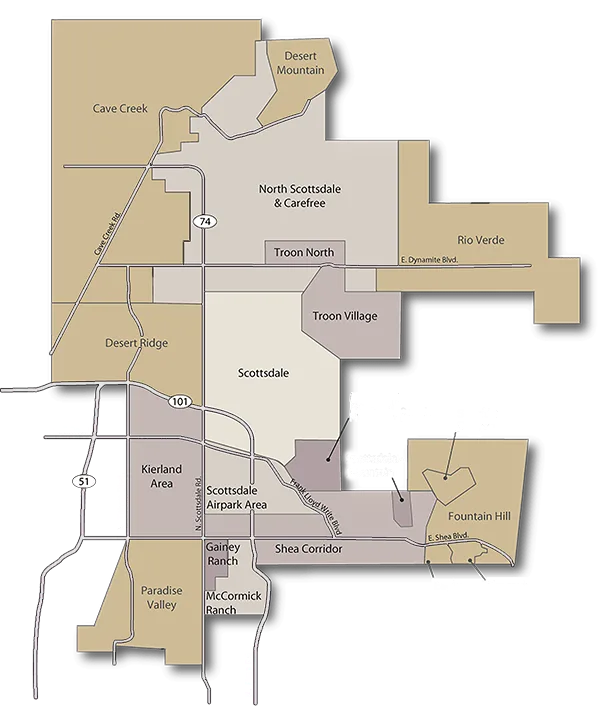

Diversification is critical to minimizing risk. While investing in what you know is essential, it’s equally important not to stop there. Just like a sturdy table needs more than two legs, a well-rounded portfolio should have multiple pillars to support it.

5. Rethink Traditional Retirement Accounts

Conventional retirement accounts like 401(k)s often have hidden fees, mainly taxation. You’re essentially trading strong dollars today for weaker ones in the future, especially as tax rates increase over time. Instead, consider the tax-free growth offered by whole life insurance policies, ensuring you can access your funds when needed.

6. Plan for Your Legacy

Beyond retirement, many middle-aged adults worry about what happens after they’re gone. The death benefit from your policy can provide a tax-free financial legacy for your loved ones, ensuring your wealth continues to benefit future generations.

7. Regularly Monitor Your Policy

Consistent monitoring of your policy’s performance is crucial. Adjust contributions and investments as necessary to keep everything on track. Educate yourself, understand the metrics that matter, and know who to consult when changes are needed.

Take Charge of Your Financial Future

The most important takeaway? You call the shots with your stash! You decide when, how much, who, how often, and why. You’re better positioned to win the financial game when you control your financial strategy. Becoming your own banker means you set the rules because no one is more invested in your financial future than you are.